step 3. Determine the full home loan attract paid

2nd, you ought to pick one certified costs associated with the fresh HELOC. The fresh new TCJA restrictions this new deduction to have attention to the family security financing and HELOCs to help you costs associated with the purchase, framework or improve from an experienced house. Regarding home improvements and you can repairs, these include replacement the rooftop, installing a unique Cooling and heating program, refinishing wood floors, surroundings, masonry work and much more.

Every one of these situations has some will set you back, and work and you will product. It is important to song these expenditures very carefully and maintain an in depth number of all of the expenses associated with their HELOC-financed strategies. It means recording how much cash you used on each passion and staying people receipts and you will bills. Financial comments could also be helpful bring an in depth report walk out-of all these transactions in the eventuality of an Internal revenue service audit.

After you have gathered every requisite records of your qualified HELOC-funded costs and you may activities, it is time to assess the quantity of focus you paid off on your financing. The monthly HELOC comments offers an in depth overview of the fresh overall focus paid back more than certain months. Particularly, for individuals who got aside a HELOC in the and you may repaid attention on the they for the rest of the season, your declaration will teach the amount of notice paid for the fresh whole season. Your lender also needs to deliver a questionnaire 1098 every year one contours the level of loan notice your purchased taxation purposes.

4. Prove the full allowable desire

After you have calculated their full home loan notice reduced, it is vital to make sure the total deduction number. Keep in mind that HELOC attract no bank account loans Conejos CO is just tax-deductible to your first $750,000 away from full being qualified indebtedness ($375,000 in the event the married submitting ounts outside the first $750,000 isnt tax-allowable. You will have to seem sensible the total amount of HELOC attract purchased the newest tax season, deduct people low-deductible amounts and you may go into the complete on your own tax get back.

5. When in question, talk to a tax top-notch

Like with almost every other serious tax-associated issues, it is advisable to talk to a professional taxation elite group in the event that you might be being unsure of on how to properly statement your own HELOC taxation make-off. A professional can assist guarantee that you might be correctly revealing your HELOC focus income tax deduction into Internal revenue service, together with provide advice toward any other you are able to tax-saving tips that will apply to your unique state.

Most other income tax ramifications out-of HELOCs

Together with the HELOC taxation effects in the list above, you will find some tax-related circumstances well worth clarifying. First off, HELOCs commonly taxed as regular money, while they depict currency loaned instead of attained. Next, some jurisdictions (a number of says and you can less municipalities) demand a home loan tape taxation towards home collateral funds and you can HELOCs, that’s generally speaking a percentage of the overall loan amount. Finally, deducting attract money for HELOCs will demand that capture an itemized deduction rather than the fundamental deduction. Sometimes, you could owe shorter within the taxation by bringing the fundamental deduction.

Really does HELOC affect assets taxation?

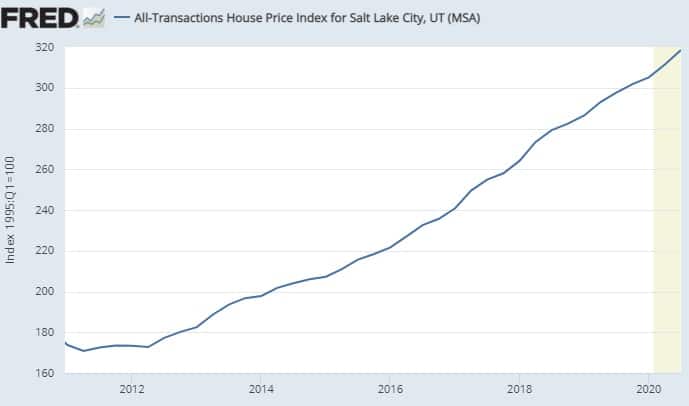

For the majority jurisdictions, precisely the appraised property value your house together with appropriate local taxation speed influence your home goverment tax bill. As a result, the degree of HELOC you take away wouldn’t apply to your house taxes. Although not, if you use arises from the latest HELOC to finance certain household improvements or upgrades one to result in the appraised value of their home going upwards, after that your property fees could potentially raise. Instance, if you utilize an excellent HELOC to add another type of pool or make almost every other high advancements to the assets, nearby assessor might take that it into consideration when estimating the property value your home having taxation objectives.