Fees such as for example credit card debt is actually paid in full:

When a possible home visitors submits a home loan app, the lending company inspections the credit get. This is certainly titled a silky query. Ahead of disbursing that loan, the lending company works a painful query that has to be approved because of the prospective borrower. So it tough query enables the financial institution to receive reveal credit file of your own debtor. It will help the lender generate a far more told decision just before disbursing our home loan.

A challenging inquiry has actually an impact on the financing score, which effect stays on credit report and score for couple of years. Ergo, a debtor is conscious not to enable it to be a lot of hard questions by detatching the amount of loan requests registered.

A home loan disbursement will certainly reduce the credit rating significantly, although debtor can certainly improve it score because of the settling the EMIs promptly plus in complete. A default such a put-off in the percentage otherwise partial payment regarding EMI will impact the CIBIL score adversely.

With of numerous outstanding funds will always influence new credit rating and function part of the financing statement. This also decreases the odds of taking a unique application for the loan accepted easily.

Just how to take a look at individual CIBIL rating?

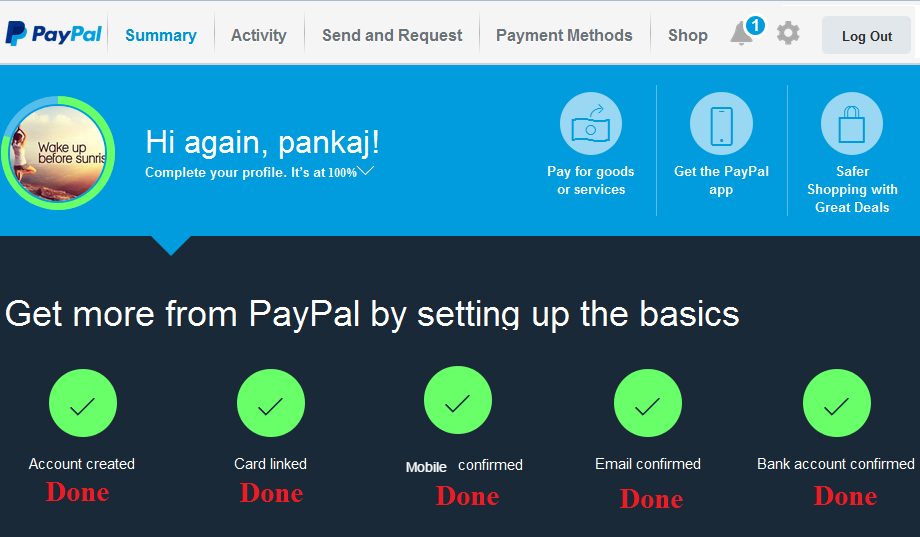

Profiles can watch their CIBIL get after from year to year through the specialized CIBIL webpages. They’re able to including spend and watch the new CIBIL rating any number of that time. They can realize these types of tips to access its CIBIL get:

https://paydayloanalabama.com/triana/

- Open the brand new homepage of the specialized CIBIL webpages.

- Select the mark Rating CIBIL score, clickable on the internet site.

- Select a plan based on how a couple of times the fresh CIBIL get should be viewed.

- Enter into basic personal statistics eg go out off birth and make contact with facts like phone number and you can email ID.

- Over registration because of the typing a different sort of code.

- Find the sorts of regulators-approved ID whereby the fresh new verification procedure would be complete.

- Enter the proper facts as previously mentioned throughout the regulators-issued ID.

- Be sure name of the answering unique questions accurately.

- Proceed to make required payment based on the package chosen.

Just what influences the credit get?

A credit rating tends to be influenced by many different factors. Knowing them may enable individuals to build wise economic decisions that boost their borrowing from the bank and enable these to receive positive interest levels towards any possible future financing.

The historical past from paying dues:

The greatest negative influence on a credit score is actually shed an EMI or bank card percentage otherwise expenses after dark due time. When someone will pay the credit card expenses otherwise EMI timely, its thought to be an optimistic factor in their credit history; however, when they you should never, it is viewed adversely. This will be something that finance companies along with get a hold of because it is one particular manifestation of someone’s capacity to pay financial obligation.

Which have handmade cards, you can love to pay the lowest amount due monthly and you may carry-over the remaining equilibrium. This may in addition to ignite many interest in some cases. Yet ,, failing to pay with credit card repayments promptly plus full is also somewhat lower an individual’s credit history because introduces second thoughts regarding their power to pay back financial obligation.

Current established money or other dues:

A person’s capability to repay a loan might be lower in the event that he could be currently indebted. This is why, any delinquent expense otherwise unlock funds will lessen the credit history. Financial institutions or other creditors could well be aware that even in the event you’ve been prompt investing your existing expense, taking up the extra lbs out-of paying off that loan would be challenging. They want to therefore move slowly moving on.