This would perception the manner in which you repay your loan

- Large financial company costs: If you are using a mortgage broker so you’re able to discover and you may safer a mortgage, they may charge you due to their properties.

- Insurance: When you have home financing, you are going to always need to have building insurance to cover ruin to your property. You can also you would like other sorts of insurance, such as public-liability insurance.

Protecting a commercial mortgage can take more than protecting a domestic financial. These types of mortgage loans tend to involve complex possessions versions that need comprehensive critiques. This will increase the day it will take to get the loans you would like.

Less autonomy

A commercial home loan is actually an extended-identity union that usually persists anywhere between 3 and you may twenty five years. Because of this if you want to disperse your company for any excuse, it may be more complicated for many who own your home. You would need to offer your property before you flow, that will devote some time or produce a loss in winnings.

Taking on a mortgage boasts particular threats. Assets beliefs may go off in addition to upwards. In the event your worth of reduces over time, forget the might end upwards getting value less than everything you taken care of they.

There are also threats if you cannot match your own mortgage repayments. In case your team faces financial difficulties one to prevent you from paying the mortgage, you can chance dropping the house. From inside the a bad-case situation, this might lead to the failure of one’s providers.

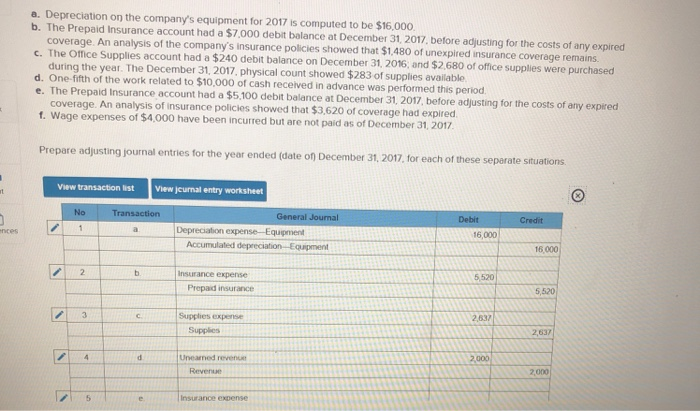

You could determine their rate of interest having a professional financial calculator. You’ll submit the home really worth, amount borrowed, and you can mortgage label. You will then receive a keen illustrative payment predicated on latest mortgage rates.

The interest rate you get for the home loan relies on individuals items. We high light the factors you to definitely impact a professional home loan to possess holder-occupiers below:

Credit score

Your credit score while the credit history of your providers are important aspects. A healthier get can display loan providers your less of a threat, that may indicate youre eligible for lower interest rates than just if you had a poor credit get.

A large financial company might be able to help you to get a good industrial home loan that have poor credit, since there are loan providers that are build to help with some items.

Industrial credit sense

Commercial financing experience may affect your capability to help you obtain. Loan providers see prior successful repayments due to the fact proof monetary accuracy and you will the ability to would a professional possessions and you will financial.

Owner-occupied commercial mortgage loans for brand new businesses are supplied by fewer loan providers, but could be offered. A professional agent can help you determine loans in Millville the choices.

Business profits

Lenders will look at the business’s financial situation. This consists of your earnings, earnings, and you will financial obligation membership. Whether your business cash was match, you can even be eligible for rates of interest having a bigger set of lenders, and you may probably lower prices.

Property

A the house or property might be used in influences the borrowed funds to really worth you can safe. Often medical methods is safe doing 100% financing so you can really worth, while other opportunities expect to have down cover.

Similarly, which have a partial-industrial possessions comprising both company and you can residential local rental points, the mortgage in order to value would be impacted by the latest proportion away from for every feature.

More home-based the greater (however, we have been specifically speaking of a domestic function that will getting hired in order to a tenant, as self-career is capped in the forty% of your plot).

1st rates period

With regards to the state of financial field, the size of the first price chronilogical age of a professional mortgage could possibly get determine the speed.