A healthier credit rating is the cornerstone in your home purchasing qualification

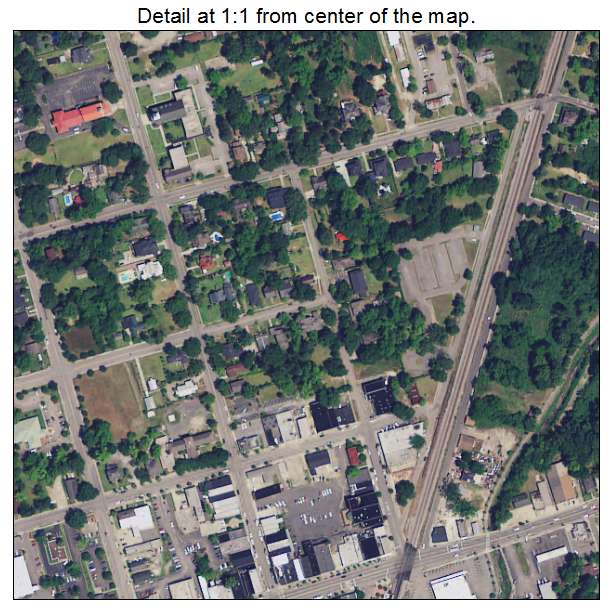

Seeking to really make a difference in a number of communities? Buying a home from inside the appointed target section could possibly offer a whole lot more easy official certification and incentives. Such apps try to rejuvenate areas and come up with homeownership obtainable, often having pros such as for example shorter home values or income tax incentives.

Having searched the types of people just who belong to the first-date house visitors umbrella, it’s vital to comprehend the second level from certification you to pave the best way to homeownership.

For those who meet the very first qualifications demands, more preferred laws generally speaking need to be came across for the buy to help you qualify for an initial-go out home customer loan program. Let’s talk about all these to be certain you are completely available to exactly what lays ahead.

Against the trust you to definitely a beneficial 20% down payment is definitely expected, of a lot very first-time home customer software give reduced criteria-either as little as step three%. Certain programs, such as for example Va and you can USDA money, can even waive the newest downpayment demands totally for qualifying candidates.

Debt-to-earnings standards

Your debt-to-earnings proportion (DTI) is a significant scale loan providers used to determine your ability so you can perform monthly obligations. An effective DTI out-of 43% otherwise all the way down can be well-known, although some applications may permit higher percentages. This proportion helps loan providers know if you could conveniently pay for the home loan close to your costs.

Credit history conditions

Most first-go out household buyer apps wanted a minimum credit rating, tend to around 620, to be eligible for antique fund. But not, particular apps, like FHA financing, are more easy, enabling results as low as 580 if not straight down having higher off costs.

Credit history

Beyond just your credit rating, lenders often remark your credit score having models out of in charge credit fool around with. Later repayments, high credit card balance, and you will accounts inside collections are warning flags. A flush credit score paints a picture of economic precision.

A job record

A reliable a job history, fundamentally for the last 2 yrs, is key having mortgage approval. Loan providers make use of this to ensure income stability and you can expect coming making possible. Frequent business transform or holes in the a job can boost issues about money consistency.

Income balances

Lenders select regular, reliable earnings when determining loan qualification. It indicates having a regular work records, generally speaking the past a couple of years, and you may facts that earnings will stay. They reassures lenders which you have the new means to suffer financial costs over time.

Income limits

Of numerous earliest-day household client software set http://www.clickcashadvance.com/installment-loans-va/clover earnings limitations in line with the Urban area Average Income (AMI) to be certain access to. Your qualifications for certain loan sizes and you can advice programs could be influenced by your children earnings in accordance with the AMI in your area. Income constraints help make certain that moderate and you will lower-income property are it’s using this type of software .

The latest official certification to have a primary-big date domestic consumer may differ between credit associations, so conducting comprehensive research is secret. Additionally, this type of criteria may notably will vary depending on the certain basic-time home client mortgage you choose.

You may be thinking which qualifies while the an initial-day family customer otherwise tips navigate new maze away from mortgage choices. Fortunately that we now have specialized mortgage apps designed for only some body like you.

These mortgage loans tend to come with perks like lower down payments and a lot more flexible credit history requirements, every and come up with that step on the possessions steps a bit less steep. And most preferred reduced-down-percentage mortgages is actually open to each other repeat and you may earliest-big date consumers.

Traditional loan

That is a greatest option for someone to acquire the very first household. This has a predetermined interest rate and you can monthly installments one to stay the same to your lifetime of the loan. Conventional mortgages often have an advance payment requirement of about 3% so you’re able to 5% of one’s cost of your house, causing them to available to a lot of consumers.