Home security money are an easy way to pay for higher expenditures. Heres how to make many of one’s mortgage

Making use of their residence’s collateral would be beneficial in different ways. You have access to the cash needed seriously to safeguards tall costs, alter your finances and for other things you will find fit.

Nonetheless, you will need to go ahead having warning when borrowing from the bank from the roof more than your mind-failure to make quick money can lead to foreclosures

What is actually home equity?

Family guarantee ‘s the portion of your house that you’ve reduced regarding. It’s the difference between just what home is value and how much is still owed on the home loan. For most, collateral away from homeownership are a button way to create personal riches through the years. Since your residence’s worthy of increases along the long term while lower the primary with the home loan, your own equity expands.

Collateral will bring of several opportunities to home owners, as it’s a beneficial origin for savings and for money, states Glenn Brunker, president at the Ally Home. For example, the fresh new security obtained from inside the a beginning house will get later on supply the down-payment necessary to purchase a larger family given that a family develops and requires americash loans Brush more space. Its a period of time-checked out answer to make money.

Household equity is generally useful for big costs and regularly represents a far more pricing-effective money option than just handmade cards or personal loans with high rates.

Just how home security really works

The most common a means to availableness the latest collateral of your house try an excellent HELOC, a property equity loan and a finances-away re-finance.

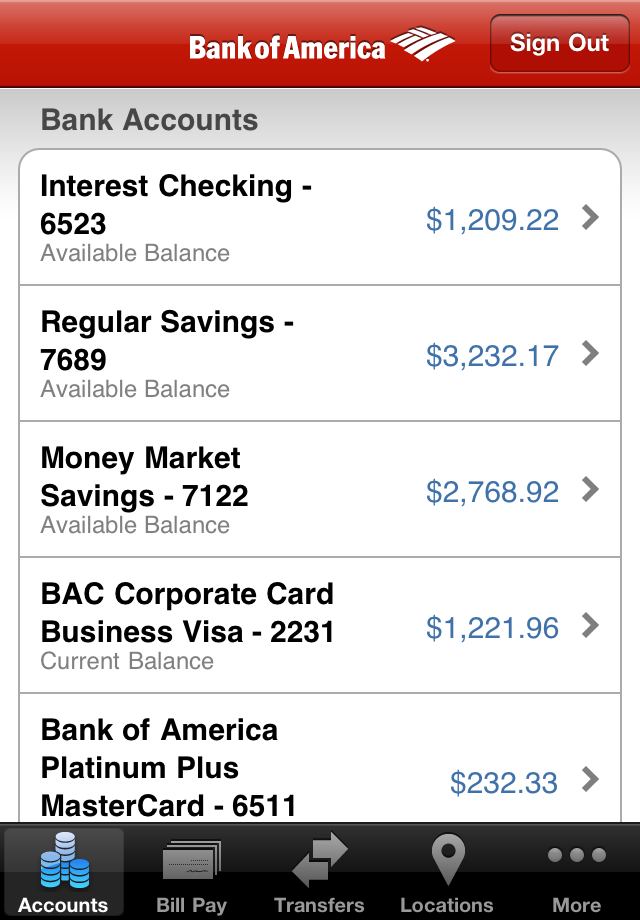

So you’re able to tap into the residence’s equity as a consequence of one among them solutions, you will need to experience a method similar to obtaining an effective financial. You might apply through a financial, credit commitment, on the web bank or other financial institution which provides these household guarantee circumstances.

Lenders have a tendency to think multiple points, including another person’s loans-to-earnings ratio, loan-to-well worth proportion, credit rating, and you will annual earnings, said Michele Hammond, older house credit coach at the Pursue Private Customer Home Credit. At exactly the same time, to determine the amount of equity from inside the a home, a lender commonly apply an appraiser to search for the market value of the house, that is according to their standards and comparable properties in the area.

As to why use family guarantee?

Scraping your house guarantee might be a handy, low-pricing cure for obtain huge amounts in the advantageous rates in order to pay money for home repairs otherwise debt consolidation.

If you are looking to pay since you go and simply pay for what you’ve borrowed, when you have lent they, a beneficial HELOC is likely a far greater choice, states Sean Murphy, secretary vp off guarantee financing from the Navy Federal Credit Relationship. But when you seek a predetermined monthly payment and you will a massive sum of money up front, a property equity financing is probably the more sensible choice.

7 how do you use a property equity loan

There are pair restrictions regarding how you should use your house collateral, however, there are some effective ways to maximize of your financing or personal line of credit.

step 1. Home improvements

Do-it-yourself is one of the most well-known explanations residents just take out house equity financing otherwise HELOCs. Besides to make a property more relaxing for your, enhancements may increase the residence’s worthy of and you will draw so much more desire regarding prospective buyers after you sell later.

Household equity is an excellent option to finance large projects including a kitchen repair which can raise a residence’s value over the years, Brunker claims. Repeatedly, these types of investment covers on their own by the enhancing the residence’s worthy of.

Another reason to adopt a home equity loan or HELOC getting renovations is you can deduct the interest repaid with the family collateral money of up to $750,one hundred thousand if you use the borrowed funds financing to buy, build otherwise drastically improve the family you to definitely secures the loan.