Just how Medical practitioner Mortgages Work with Washington D.C

The latest underwriting cluster might be versatile having education loan debt therefore early-profession medical professionals have been in a far greater position to meet the requirements. Like many physician loan applications, consumers may use a future-old employment contract since the proof of making potential installment loans online Missouri.

six. Truist Bank

- Better business bureau Amounts: A+

- JD Power Score: 598

Truist Lender extends their doctor financial program so you can borrowers with an MD, Would, DPM, DDS, or DMD education. People are included.

All the individuals should be within this fifteen years from birth their professions, however, individuals inside basic ten years of the jobs will qualify for a minimal down-payment options.

The program possess a max amount borrowed away from $dos mil, however, down payment selection will come right down to seniority as well as the credit acceptance process.

Borrowers in basic 10 years of their work can be considered to possess 100% financing, but individuals within 10-15 years out-of beginning its careers will need to put down at the least ten% of your home’s purchase price.

Non-long lasting people are eligible, but they need put down no less than 15%. The applying enjoys minimal set aside conditions, however these numbers will depend on the entire loan balance.

Borrowers also can cash out re-finance up to 80% of their no. 1 residence’s assessment value. They could occupy to $fifty,000 bucks however, any financing must be used in order to meet an excellent personal debt.

Fixed and you will adjustable-rates mortgage options are readily available. Loans can be used to get attached or isolated condos, townhouses, and you may services in a planned product development.

7. U.S. Financial

- Bbb Stages: A-

- JD Fuel Get: 667

U.S. Bank constraints its medical practitioner mortgage program so you’re able to health practitioners and medical professionals of osteopathic drug, but residents and you can fellows come. Every individuals must have an excellent 710 minimal credit score, nevertheless program will not demand a get older restriction.

The application form have a maximum loan amount of $dos.5 mil, however, advance payment alternatives differ. The program doesn’t have a beneficial 100% investment solution, generally there might possibly be specific costs to adopt.

Individuals can be be eligible for down payment possibilities only 5% on the loans as much as $1 million. Loans up to $step 1.5 million requires good ten% down-payment. Funds as much as $2 billion will need a beneficial fifteen% deposit.

PMI is not needed. The application form won’t ignore student loan debt entirely, nonetheless it could well be versatile. To possess borrowers within the deferment, 2% of the overall mortgage harmony was regularly assess the DTI proportion.

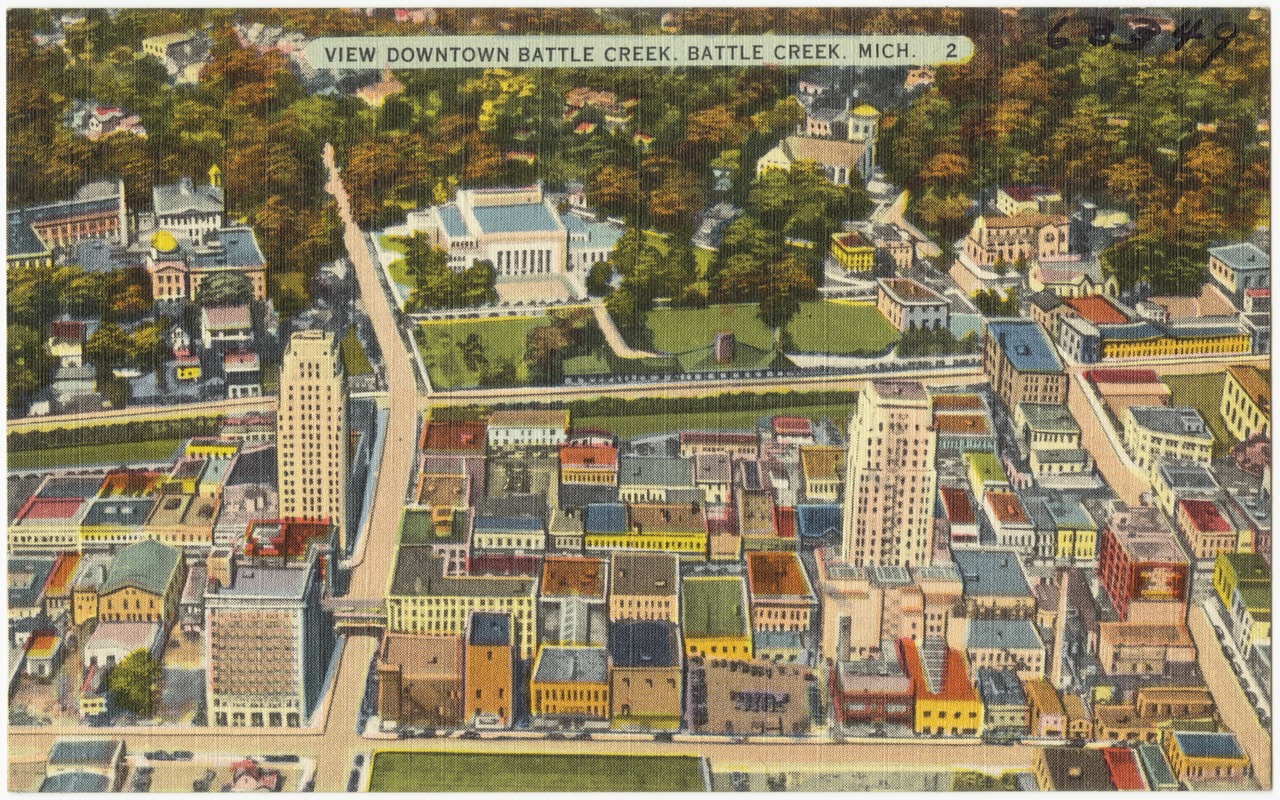

Arizona, D.C., as well as the surrounding town are notable for its shocking a home prices and you may total high cost of living.

Whilst it comes with many state’s most impressive healthcare facilities and you will colleges, pair early-field physicians have the income and you will debt tolerance needed to make an aggressive bring such a challenging industry.

High Financing Number

FHA financing and you may conforming conventional loans is capped within $step one,089,three hundred towards purchase of solitary-family houses. That it amount borrowed is significantly more than various other regions of the nation, although mediocre home rate into the Arizona D.C. is additionally higher at $630,778.

Medical practitioner mortgage loans give doctors access to big mortgage numbers than authorities-sponsored and you may old-fashioned financing could offer. The entire loan amount you be eligible for is dependent on your own credit rating, earnings, and you may DTI proportion, nevertheless the regular physician financing system now offers an optimum amount borrowed ranging from $750,000 and you may $step one.5 mil.

Particular doctor loan programs is actually way more largegiving more than $2 mil to help you accredited consumers. Borrowers is safer such loan number to own a reduced downpayment compared to the old-fashioned mortgage loans.

The common traditional mortgage need an excellent 20% down-payment otherwise consumers will have to make monthly PMI payments. PMI is a share of your overall loan balance and it’s really set in every home loan repayments if you don’t arrive at 20% household guarantee. While doing so, doctor mortgages may well not require a downpayment whatsoever, however, almost every other down-payment options can vary away from 515%.