Should i Obtain 100% out-of My Domestic Security?

- Go through the underwriting processes: The lending company often comment the job, and you may an underwriting party will work to ensure your details and you will touch base that have any extra questions. During this time period, you might be questioned to prepare a home assessment to help you show the worth of the home. This process usually takes 2-3 weeks. In the event the everything you encounters, you may be approved, and an ending go out could well be lay.

- Discovered your loan: The last step should be to personal the borrowed funds and you can signal data files encouraging to repay. Make sure you see the borrowed funds disclosure carefully and come up with sure you are aware the obligations and you will establish all the quantity. Once you complete closure, the cash will be paid into your membership of preference.

Solutions so you’re able to Household Equity Loans

There is certainly lots of reasons for maybe not qualifying for property guarantee mortgage, although typical aren’t having enough security, maybe not meeting the financing or DTI minimum conditions, or not having an established income source. Or even meet with the lender’s qualifications, or if you only decide it isn’t ideal unit to you personally, there are more credit options to imagine.

- HELOC: Property security credit line is an additional treatment for faucet in the house collateral, but alternatively off a lump sum payment, you’ll get an effective rotating credit line. It indicates you can obtain the main current credit restriction, spend the funds, pay off those funds with interest, after which take currency aside again within a-flat identity.

- Personal loan: These funds are apt to have large interest levels than simply a property collateral mortgage. Because they’re personal loans, you may not place your household and other equity on the line.

- Cash-out re-finance: Should you want to refinance your existing mortgage, you might mention an earnings-aside refinance, hence adds an extra matter on to a separate home mortgage you to definitely was paid back for your requirements while the a lump http://paydayloancolorado.net/frederick sum payment. This package including pertains to an extended application procedure and settlement costs. Whenever you are capable lower your rate of interest or raise your home loan terms in some way, however, it may be a good idea.

- 0% Annual percentage rate charge card: If you want to make a large buy (although not too large) you think you could potentially pay back contained in this per year otherwise a few, a credit card that have an excellent 0% Annual percentage rate basic give can provide you with a while and then make payments interest-100 % free. Specific credit cards offer up to help you 18 months. This new drawback is that if you never complete the rewards, then the interest rate on your own left harmony could well be rather more than a home collateral mortgage.

- Certificate regarding put (CD) loan: For those who have money in a great Computer game, you can search for the that loan you to allows you to make use of the Video game since the guarantee. It is a variety of secure mortgage.

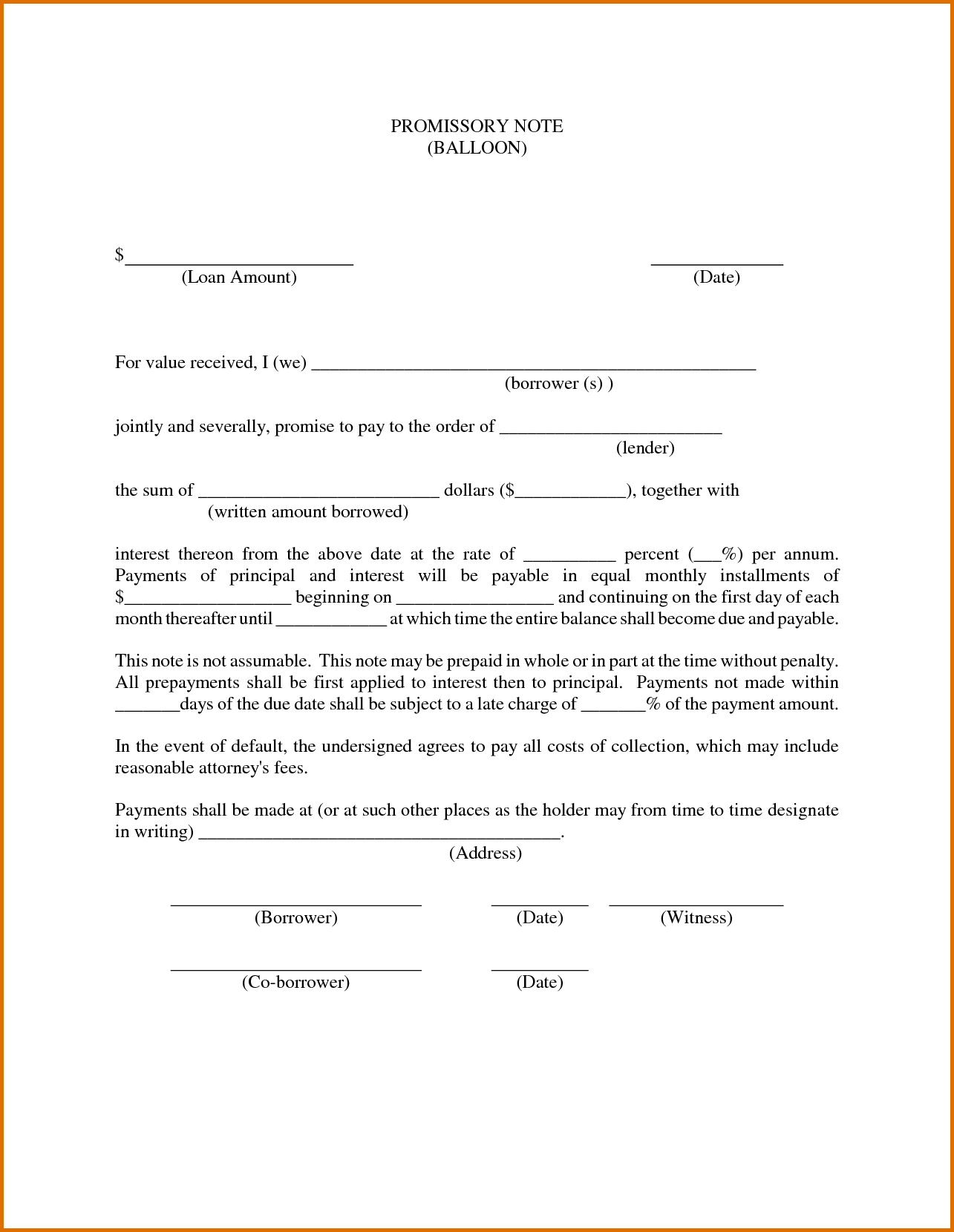

- Family members financing: Borrowing out of family relations or nearest and dearest is an additional substitute for envision, however you will would like to try in order to formalize the loan in certain means thus everyone understands the brand new conditions. The danger is that you could put your dating in jeopardy if you had problems repaying the loan.

Very loan providers will need you to has actually no less than 15% to help you 20% guarantee of your house before and after the home guarantee mortgage. Like, if the home is already really worth $three hundred,000 while nevertheless are obligated to pay $270,000 on your own financial, your own guarantee is actually $30,000, otherwise 10%. If that’s the case, you almost certainly would not qualify for property collateral financing.

What’s the Ideal Have fun with getting a home Guarantee Loan?

Household security loans is also generally be used unconditionally, nevertheless the most frequent of them is actually: to pay for property improvement enterprise otherwise fix, to combine large-appeal obligations, or perhaps to pay for an enormous bills such medical expense otherwise a marriage. It is up to you in order to weighing regardless of if their reason on the loan are a deserving that, however, remember that you might be borrowing against your home, so that you don’t want to make one to choice lightly.